Why does greenness matter to the investor?

The recent research paper Portfolio greenness and the financial performance of REITs by Piet Eichholtz, Nils Kok, Erkan Yonder on the website of the European Centre for Corporate Engagement found that in the USA greener REITs had higher Return on Equity, higher Return on Assets and higher Ratio of funds from operations to total revenue. The greener REITs's stock also had lower market beta, or volatility. The only somewhat disappointing result was that the green REITs did not exhibit excess or abnormally higher stock returns, a finding that the authors suggest is due to the fact that the stock prices have already incorporated and reflect the green advantage.

That there is a green advantage makes sense. Green buildings require proportionately less energy, lowering the impact of energy price shocks and stabilizing returns from properties. Energy is a big cost component. Buildings in the USA consume 74% of electricity and commercial property (which make up the holdings of real estate companies) makes up half of that. Greenness isn't just energy saving - greenhouse gas emissions, waste reduction and water consumption matter too.

Greener buildings have a longer economic life. Tenants prefer them and green buildings command higher rents (3% more per Eichholtz) and resale prices (+13%). There is less risk from the impact of future government regulation (is environmental regulation likely to get less or more we ask?). Green building certifications like the worldwide LEED (Canadian buildings listed here at Canada Green Building Council website), the US Energy Star, the Canadian BOMA BESt and various others in different countries, have rapidly gained acceptance.

The savviest investors, in the form of institutions like pension funds, are already paying close attention (as our previous post on Socially Responsible Investing noted). Some of the most convinced have extensive Canadian properties. The giant Canadian pension fund OMERS owns Oxford Properties Group, which assigns high priority to pursuing, reporting on and achieving sustainability in its business. Bentall Kennedy, owned in part by the BC Investment Management Corporation and CalPERS, is a world leader according to the Global Real Estate Sustainability Benchmark (GRESB) - see the 2012 GRESB report. Bentall Kennedy's view in its 2012 Corporate Responsibility Report on the Global Reporting Initiative database is that "corporate responsibility is simply better business" and will eventually produce superior returns. Ivanhoé Cambridge, owned by Quebec's huge Caisse de dépôt, is another real estate heavyweight with extensive Canadian properties that is fully committed to sustainability and greener buildings. The same goes for Cadillac Fairview, owned by the Ontario Teachers Pension Plan.

The following chart from the Oxford 2012 Sustainability Report neatly summarizes how greenness can benefit the real estate company, along with its tenants.

How do the publicly-traded Canadian REITS and real estate corporations stack up?

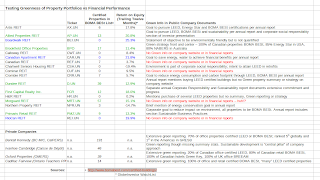

Since the individual online investor cannot of course buy shares in Bentall Kennedy or other privately-owned entities, we looked at TSX-listed real estate shares, mostly REITs, along with a few corporations. Our comparison table shows what we found. Ideally, we would have wanted to get summaries by company of the green-certified proportion of their property portfolios and then to compare their financial performance to see to what degree green does best in Canada.

1) The data looks spotty and incomplete and the degree of green commitment is often hard to determine - Only one company, Brookfield Office Properties, publishes how much of its portfolio is green and it is impressively high considering that Eichholtz estimated that only 1% of US REIT properties were LEED-certified in 2010 and only 6% Energy Star-certified.

But there are a number of strange things we found. The BOMA BESt database lists no less than 57 green properties under Morguard yet the company's website and annual reports say nary a word on green, sustainability, BOMA, environment, corporate responsibility or other such catchphrases. It seems odd to be just doing it and not talking about it. Even harder to fathom is that the biggest Canadian REIT by far, RioCan, says nothing about green on its website or in its reports and there are exactly zero of its buildings in BOMA BESt. In a telephone call, a BOMA representative could say that there are a few RioCan properties in the process of certification. A call to RioCan unfortunately did not elicit a response. It is hard to believe that RioCan is paying little or no attention to greenness.

The other popular green certification is LEED and a list of certified buildings is on the Canadian Green Building Council website here. Unfortunately, the 2600 buildings, which includes single family homes, does not identify property owners, only addresses. Linking the addresses back to the companies would be a very laborious task.

2) Several companies appear to have a very strong commitment to greenness - That is shown by strong statements and specific sustainability/responsibility reports: Allied Properties REIT (AP.UN), Brookfield Office Properties (BPO), First Capital Realty Inc (FCR) and Primaris Retail REIT (PMZ.UN). It's not only words, they have more BOMA BESt buildings too. Dundee REIT (D.UN) seems, like the puzzler Morguard, to be another company of action not words with its high number of BOMA BESt buildings.

3) Green companies generally achieve reasonable return on equity (ROE) - The green-highlighted companies with the most BOMA BESt listings all sport a healthy ROE.

4) Green certification is not the only route to success - Three companies (highlighted in blue) with not a single BOMA BESt listed property - RioCan, Canadian Apartment REIT (CAR.UN) and Boardwalk REIT (BEI.UN) - have excellent ROE. Thus, a focus on greenness is not the only way to achieve high returns. Maybe these companies are doing the green cost saving measures, or others not specifically green, and not bothering with certification.

Nevertheless, green certification of buildings in real estate portfolios is a useful indicator of investing value for the investor.

Disclaimer: this post is my opinion only and should not be construed as investment advice. Readers should be aware that the above comparisons are not an investment recommendation. They rest on other sources, whose accuracy is not guaranteed and the article may not interpret such results correctly. Do your homework before making any decisions and consider consulting a professional advisor.

1 comment:

Thank you for providing the information. Green certification has now become necessary to control the environment of the earth.

I would like to tell that, I recently came across a site on internet named the spinnaker group inc who is providing the service of green building, leed certification etc.

What Is Green Concept? for green certification of buildings.

Post a Comment